Disclaimer: The purpose of this blog is not intended to induce or promote any insider trading or manipulation activity. This blog is created for the sole purpose of education, discussion and knowledge sharing. All charts and information can be obtained freely from the public internet. All analysis are based on my own personal view and years of experience. It should not be used as a decision to solicit buy/sell activity. Use all information at your own discretion and practice due diligence.

Pages

- stockmarketmindgames

- The K Theory

- K Philosophy

- Track & Trade Record

- Charity

- Company Information

- Business Opportunities

- Contact Me

- About Me

- Advertising

- Media

- Partners

- Stock Operation Course Summary

- Stock Operation Course Outline

- Mind Analysis

- Testimonials

- The Science Behind Precision Timing

- LIVE Trading, Events, Sharing Videos

- The Retrovention Of Contra Trading

- 1 On 1 Personal Coaching

- Stock Operation Course FAQ

- Stock Operators Maneuvers Manual

- Stock Operation Framework

- FREE Training Workshop

- Disclaimer

Monday, October 31, 2011

Saturday, October 29, 2011

Noble Group - Shorted

I shorted noble group yesterday. It's always my favorite. Don't have to consult me which stocks I am watching because noble is definitely one of them and those like Kepcorp, Sakari, Yangzijiang, Yanlord, SGX, etc..those are in my watchlist everyday. Actually, those that I blogged about, they are the ones that monitor daily, but noble is exceptional. If you want to follow me, put noble in your watchlist everyday!

Ronald K - Market Psychologist - The Big Speculator

Labels:

STI

Friday, October 28, 2011

The Month In Review

As I was going through my blog posts, I saw a lot of calls I made in the past month and it made me wonder is my K strategy the most sought after strategy by many? I don't know but when I see stocks like SGX, Tiger, Yanlord, Kepcorp, Noble, etc..and the list goes on, all of my analysis were spot on. I am glad for those who made money and emailed me and say thanks Ron, I had recoup some of my losses or thanks Ron, because of your blog, I made some money and donate some to charity. As I continue my saga with this blog space, I hope I can influence those who lost money in the past and bring their confidence/happiness back.

Ronald K - Market Psychologist - The Big Speculator

Ronald K - Market Psychologist - The Big Speculator

Labels:

market outlook

STI - Weekend Blues

As the day progresses and before STI closes or even before Dow Jones opens tonight. I already knew what is going to happen next week. Happy trading everyone!

Ronald K - Market Psychologist - The Big Speculator

Ronald K - Market Psychologist - The Big Speculator

Labels:

STI

STI - Profit Taking

I saw some BBs taking profits on 9:06am. Sorry did not post as I was swamped by work and stocks. Those who attended my seminar should keep your eyes opened on that level I gave out. Did it hit? you decide.

===============================================================

One more thing, where is the 2800 resistance?? Anonymous, or I should say GY, can enlighten me?

Anonymous said...

On the 21 oct you said tiger air is bullish enough for you. I told my friend is bullshit.. and indeed, you are bullshiting. It fail to breakout at resistance. Those who holding it beware..!! Right issue going to end. Good luck..!!

After your tiger post, you said you will long if there is a chance. Then when market down abit you said really for short. You have NO skill the see the how the market move. Please go and learn more and get more skillful before you post it on your blog.

Lastly, everyone know STI have a resistance at 2800..!!

Ronald K - Market Psychologist - The Big Speculator

===============================================================

One more thing, where is the 2800 resistance?? Anonymous, or I should say GY, can enlighten me?

After your tiger post, you said you will long if there is a chance. Then when market down abit you said really for short. You have NO skill the see the how the market move. Please go and learn more and get more skillful before you post it on your blog.

Lastly, everyone know STI have a resistance at 2800..!!

Labels:

Major Turns,

STI

STI - Vigilance

I am not doing anything today unless I see an opportunity for me to action. Let the market continue it's wonders while I shall be just watching. Whether or not if it reaches the level I predicted, that's not important, the most important thing is the moment when heavy selling or huge profits exudes themselves, I shall be there with the BBs. Vigilance and Patience is the key of a speculator and roads to multiple victories.

Ronald K - Market Psychologist - The Big Speculator

Ronald K - Market Psychologist - The Big Speculator

Labels:

STI

Thursday, October 27, 2011

STI - What's The Equation?

Today, there could be minor reactions to facilitate buying and the market might then trend upwards. To trigger a valid buy signal for myself, I would rather watch closely if this buy is truly buying from the BBs or just a fake breakout and thereafter the market would reverse. Overall it's best to be very suspicious, patient and careful. Don't punt when you are half convicted.

Update: 27/10/2011, 3:09PM

What I speculated this morning at 6am came true, wooo hooo!

Ronald K

Update: 27/10/2011, 3:09PM

What I speculated this morning at 6am came true, wooo hooo!

Ronald K

Labels:

STI

Wednesday, October 26, 2011

STI - Sardonic Rally

Why do I entitled this rally as a sardonic rally? The reason is simple, because the way I looked at it, it is not a true blue rally but a rally to redistribute more stocks. The more it rally, the more suspicious I got. However as compared to Dow Jones, the Dow rally is more sustainable and remarkable. Now, I am not pinning any hopes on this rally but the moment it turns big time, I will be shorting. Yesterday, I warned of a tricky market where one should look to book some profits first and true enough, the market was almost dull for almost the whole day where no good amount of money could be made. With today being a public holiday, I will be planning my trades for prudent execution tomorrow.

Ronald K

Labels:

STI

Tuesday, October 25, 2011

STI - Tricky

Today might be a tricky day. I am looking to book some profits. Watch!

Ronald K

Ronald K

Labels:

STI

Monday, October 24, 2011

SGX - Readiness

I love SGX at this juncture. I am timing for an entry the moment I see it's readiness to rally higher..

Ronald K

Ronald K

Labels:

SGX

STI - The 2685 Level

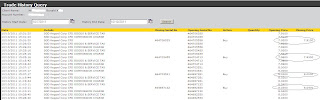

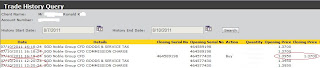

During the seminar, I think I had missed out a screen capture when STI hit the bottom at 2685. Here is a capture of the recent bottom when I made my post on 20th Oct 2011. Look at the circled dates and level figures.

http://stockmarketmindgames.blogspot.com/2011/10/sti-dearth-supply.html

Ronald K

Labels:

STI

STI - Adding Long Positions

I am looking to add on to my long positions if I see an opportunity.

Ronald K

Ronald K

Labels:

STI

Sunday, October 23, 2011

Friday, October 21, 2011

STI - Phenomenon

Yesterday I called for a long at 2680-2685. I am enthralled by my own precision because it's the BBs support level in my opinion. STI hit 2685 and we rebounded from there. I also posted a K Turn to say that STI was turning to the upside soon. That K Turn is not a buy/sell signal as I did not say turning to the upside now but instead a signal to watch out for because I saw heavy stampede buying during that period and if the BBs were already buying in, they need to create more panic before an upside is possible and that's where we saw 2685-2686 before a rally happens.

http://stockmarketmindgames.blogspot.com/2011/10/sti-dearth-supply.html

Today, I expect STI to start it's rebound. Will we witness a rally from here? I shall share tomorrow. As we march towards this weekend for the gumption seminar, I am happy to meet and exchange views tomorrow.

If you wish to thank me because you made some money off my blog, donate what you can afford to the needy or charity. That will do you good. Alternatively, you can email or post your comments to express your gratitude.

Ronald K

Labels:

STI

Thursday, October 20, 2011

Keppel Corp - Results Out

On Wednesday, 19th Oct 2011, I foresee KepCorp results would be good. http://stockmarketmindgames.blogspot.com/2011/10/keppel-corp-results.html

Today the results was released.

Today the results was released.

Keppel Corp 3rd-Quarter Net S$406.1 Mln; Above Expectations

20 Oct 2011 18:36

DJ UPDATE: Keppel Corp 3rd-Quarter Net S$406.1 Mln; Above Expectations

-- Keppel Corp third-quarter net profit rises 33.3% from a year earlier, beating analyst expectations

-- Net profit rises due to higher contributions from Offshore & Marine and Property divisions

-- Keppel's offshore & marine unit secures record $8.7 billion worth of orders so far in 2011

-- Keppel CEO hopes to secure "a fair share" of Petrobras orders

Ronald K

Labels:

kepcorp

The Gumption Seminar - Sold Out

Thanks to all who will be attending this seminar. The Saturday and Sunday slots were fully sold out. I shall speak to you all on those two days.

Ronald K

Ronald K

Labels:

market outlook

STI - Dearth Supply

I am looking to long STI either today or tomorrow, it depends. STI is currently in an undefined trading range. This trading range could represent a lack of supply. Of course this is my view and you need not follow me. There is no clear waves at the moment and it's risky to take a position. As mentioned earlier, the riskier for me, the better it is because it allows my skills to be elevated to the next level. If you want me to give a level, I will be opening my eyes wide at the 2680-2685 level. Of course, it might or might not reach there and if it does, it doesn't mean you buy there. Always watch for real buying/turns before you long. I will be watching for the K Turn to double my confirmation.

Ronald K

Labels:

STI

Wednesday, October 19, 2011

Keppel Corp - Results

KepCorp results might be good! Don't look to short today. Put this stock on your watchlist.

Ronald K

Ronald K

Labels:

STI

STI - Mouse Trap

I can't see a reason why I should long STI. I am watching for the K turn to short more Noble. Of course, should the market reverse, I will take whatever profits I have and reverse my position.

Update, Oct 19th 2011, 5.31PM

I closed all my shorts positions. Something is not right today.

Ronald K

Update, Oct 19th 2011, 5.31PM

I closed all my shorts positions. Something is not right today.

Ronald K

Labels:

STI

Tuesday, October 18, 2011

STI - Doldrums

While I was shorting all the way since last week, I cut some small losses along the way, took some profits on my operation with both long and shorts, today is the day I look to recoup all those mini losses plus huge profits. With STI up so much yesterday and I was still looking to short? Some people might think I must be insane, however, when I saw DBS, KepCorp and other big caps behaving so bearishly, I knew I have to short it or I shall regret today. It took me gumption to do it, of course it comes with conviction and confidence.

I am looking to add on to my list of shorts today. I will short on the turn using my proprietary K Turn. Many people say K Turn is the most powerful. However, without the K Mind and K Wave, the odds of having a greater percentage of winning would be greatly reduced. Now, the big question is are we still in a uptrend or continue the bearish downtrend? I knew this answer all along when STI was at 2560. I envisaged a big rally when I made my calls last month and I know how it will end since I knew what the masterminds are trying to accomplish . For those who took the effort to come to my seminar, I won't disappoint you. I will share more during that gumption seminar.

Ronald K

Labels:

STI

Monday, October 17, 2011

KepCorp - End Of A Rally?

I was actively watching KepCorp today and something caught my wildest attention. The rally today was the weakest of all after the recent ramped up in prices. Of course I shorted KepCorp and during the final hour, it slowly came down bit by bit. That was to me the end of a short term rally. Today's gap up was to trap public to buy more when the BBs were selling in the last final hour. I am looking to short more KepCorp should it rally.

Ronald K

Labels:

kepcorp

Sakari - Exhausted

I tried to short Sakari earlier just now, however there were no scripts! Anyone here can short? Please post! I was actively watching Sakari, however when I tried to test it, I couldn't. Short term wise could be exhausted. If you can't short, there are always other stocks to punt!

Ronald K

Ronald K

Labels:

sakari

Sunday, October 16, 2011

Sakari - The Exuberant Activity

Did anyone long Sakari during this bull raid? On Oct 5, I call for a long on Sakari and on Oct 6 I gave another fan of mine a clue that Sakari was going to run. The rally was indeed fierce and never took a breather. Looking at the way the operators operated this bull raid, they gave me a clue that they are winding up their operation soon in the short term. As of writing now, they are no signs of them exiting their operation yet. I will be watching this counter very closely and the moment I see signs of short selling and profit taking, I am in to short. Watch out my blog space, I might post that activity when it happens!

Ronald K

Labels:

sakari

Saturday, October 15, 2011

Insider Trading

Rajaratnam Sentence Sends the Right Message to Wall Street: View

Raj Rajaratnam, the Galleon Group LLC hedge fund executive who fought his insider-trading prosecution at every stage, today ended up with an 11-year prison sentence and an order to forfeit $53.8 million. Some are decrying the punishment as too lenient, but it is both appropriate and exemplary.After Rajaratnam’s conviction in May, sentencing was left to U.S. District Judge Richard Holwell in New York. Prosecutors wanted a prison sentence as long as 24 1/2 years, and the return of the full $72 million they say he gained through illegal tips. Rajaratnam’s defense lawyers pushed for as little as 6 1/2 years in prison, the return of $7.4 million and the chance to stay free on bail while appeals proceed.

Holwell’s sentence to some extent splits the difference -- but it does so in a way that underscores the severity of Rajaratnam’s crimes. “Insider trading is an assault upon our free markets,” Holwell said, in meting out one of the longest sentences on record for such crimes.

Holwell acknowledged the 54-year-old Rajaratnam’s health concerns: diabetes and the need for a kidney transplant. But medical centers can be found in prisons, too. Holwell refused to grant bail pending appeals, and told Rajaratnam to report to a North Carolina prison in 45 days (where, appropriately, he will join convicted Ponzi-scheme artist Bernard Madoff).

Rajaratnam still faces a Securities and Exchange Commission lawsuit against himself and Galleon. More than two dozen people have been convicted in prosecutions related to Galleon. Prison terms for defendants other than Rajaratnam have averaged 35.4 months.

The case has fascinated both Wall Street and the general public with its detailed disclosures of the ways that privileged information seeped out of boardrooms, law firms and other centers of power, to be exploited by traders looking for quick profits.

Every day, thousands of directors, lawyers, corporate officers and bankers are expected to keep privileged information secure. If any of them have trouble remembering why it’s necessary to do so, Rajaratnam’s 11-year prison sentence should help them regain their moral compass.

Ronald K

Labels:

insiders

Friday, October 14, 2011

Yanlord - Climax?

I believe there is still upside for Yanlord. The climax is not reached yet. However short term wise, please beware. The big picture still looks good.

Update: Oct 14th, 2011 2:47PM

I am out of all my Yanlord. I will resume when I see the next turn.

Ronald K

Update: Oct 14th, 2011 2:47PM

I am out of all my Yanlord. I will resume when I see the next turn.

Ronald K

Labels:

STI

Noble Group - Look To Short

Should the market reacts today, I am looking to add on to my Noble shorts. What I learned strengthened my conviction was Noble had been rally for many days and it was making lesser upside progress with the up wave being exhausted momentarily. Observing at the recent ramping up in prices, Noble is propitious to the down side. Noble is not impunity should commodities start showing signs of weakness. Personally that's how I felt and you don't have to follow my views. I am a shrewd speculator and run fast should the general tone of the market changed.

Ronald K

Labels:

noble group

Thursday, October 13, 2011

STI - The Forecaster

What more can I say about my analysis before market opens. Whatever I forecasted came true.

http://stockmarketmindgames.blogspot.com/2011/10/sti-be-cautious-and-watch.html

I profited from some stocks today and I shall hold my position till tomorrow. The big wave to me is still up, however we need reactions to see how much supply presents before further up move can materialize. We shall see. :o)

Ronald K

Labels:

STI

Yanlord - Brokeout!

Anyone longed Yanlord? This breakout is real. Woo hoo!!!

Ronald K

Ronald K

Labels:

yanlord

STI - Be Cautious And Watch

Today, the game gets trickier. I expect the market to open green weak and go south subsequently. Yesterday we witnessed a late bull charge, however I was prudent enough to tell myself not to chase it. The market is always there and there will be plenty of opportunities to enter the market. I just want to beat this game and not for the money. I will be watching closely to see if I am able to get a trade to go.

Ronald K

Labels:

STI

Wednesday, October 12, 2011

Punting Big Caps

Today was just a spectacular day in the making. Market definitely had some strength and it forced me to take my noble profits. I was still looking to short until the market finally turns. Of course, I did not made any losses while shorting. I shorted DBS and OCBC however I saw something very peculiar. I made a big profit in OCBC and after that it was all taken back. Why? Because the bid/ask price was so damn manipulated. I shorted at 8.3 the market went down to 8.22, however the ask price was still hovering around 8.29 - 8.30. What was that???? And when the market finally rallied, I need to cover it back at 8.30 which was my short price. I did not gave up, minutes later, I saw another turn and I shorted DBS and it was the same thing! Until finally the market went down further and further to allow me to rip my profits and go. KepCorp exudes the same behavior, however it was not so bad. From this incident, it made me thought for a little while and I discovered a way to punt big caps like what you saw on my DBS profits. I will share this method during the gumption seminar, so that you won't made the same mistake like I did.

Ronald K

Noble Group - Commodities Play

Noble has became one of my most favorite stock to punt in recent days. Every time I touched this counter, it made me money. It was a tricky session with Noble yesterday where it played with my psychology a little bit. However, this time round, I wasn't chasing the market like I did in KepCorp the other day. I allowed the market to rally until it turned exhausted so it presented me an opportunity to take a short. I took a short at 1.435 and thereafter the market came down. I smsed Robin to tell him that both Wilmar and Noble were weak without any rallying power. I was happy after it came down but at the same time I covered my shorts minutes later because I saw a suddenly surged and was afraid my profits would turned to losses.

I was mad at myself but experience had told me that if I don't react fast, profits would turned loss. Nevertheless, my initial judgment was correct. I should hold on instead of taking profits so fast! So I shorted back the second time and thereafter the rest is history. Of course, this time round, I had not taken my profits and is planning for a swing trade until the market turns. Now, what I want to highlight was it takes gumption to trust and believe in your judgment. If you really believe in yourself, you should follow your initial trading plan until it breaks.

Ronald K

Labels:

noble group

Tuesday, October 11, 2011

STI - Forecast

While I had my crazy operation with KepCorp yesterday, I got an answer from the market that it was absorbing all supply as it refused to go down. On Oct 4th and 5th, I called for a rally on the 2560 level.

http://stockmarketmindgames.blogspot.com/2011/10/sti-2560-level.html

http://stockmarketmindgames.blogspot.com/2011/10/sti-key-reversal.html

Those 2 days, I am very firm that the market would rally hard else I would not post my view on the blog. I posted on the forum on Oct 7th with the topic entitled "Bull Rally" but I did not share whether it will sustain or if it was just effervescent which of course back in my mind, I knew the answer which I planned to share during the seminar. On Sun night, I had a chat with a fellow follower of mine and I told him that we are in for a rally. Whether he believes me or not, it doesn't matter because I have my own way of punting the market and of course my own trading plan. Yesterday, I forecasted a dull session and I said " I don't plan to hold anything over night, just day trading." The reason was I was testing the market to check for overhanging supply and yes there wasn't any major supply and I closed all my positions before the end of the day.

So what is my plan for the future? I am only planning to long, of course, at turning points and safe prices. I can't emphasize much that each individual is different when it comes to trading or investing. I have my ways of doing things and if it works for me, it might not work for you. The best is you do your own due diligence before punting the market. Knowledge in trading or speculation is just 50% of the game, the other 50% which I find it more important than knowledge is your mental state of mind when you are in a trade. Without the correct mental state of mind, even if you have winning trades, for instance if you bought a stock at 1 dollar, you won't be taking the profits at 2 dollar but instead maybe at 1.10 or 1.20. It applies to cutting losses, if you allow a big loss to get the best of you, it's hard for you to recover again and that's where fear of punting the market sets in. That to me is fatal, personally. It takes gumption and contrary to be successful and of course cultivating patience is the key to roads of multiple victory.

Ronald K

Labels:

STI

Monday, October 10, 2011

KepCorp - My Operation With KepCorp

Am I correct again or what? This morning I foresee a dull market and I said I am looking to only short. http://stockmarketmindgames.blogspot.com/2011/10/sti-dull-session.html

True enough, the market opened and tanked all the way down and thereafter it became dull, up and down, whipsawing! Today, I was supposed to make at least 10 cents in my operation for Kepcorp, but I gave everything back to the market when it turns. I should have trust that the turn was true. Too bad, my cognitive dissonance got the best of me and I cut loss. I knew the market was going to come down in the afternoon, I trusted my analysis and went in to short again, true enough, it came down and there after I was trading like a mad dog, in and out until I said enough, I am out of this dull market. The lesson here is always trust your instinct and never allow your mind to control your actions.

I will be sharing a strategy during my gumption seminar on how to punt this market so that even though the market whipsawed, my profits will be secured. I just learned a lesson today and thought about it! Those who registered you will definitely benefit from it!

Ronald K

Labels:

kepcorp

STI - Dull Session ?

Today could be a dull session where the market could go up first then down or vice versa. Whatever the market does, I am trading intraday today. I am looking to short but at the same time if I sense some bullish symptoms I will go long. I don't plan to hold anything over night, just day trading.

Ronald K

Ronald K

Labels:

STI

Sunday, October 9, 2011

The Gumption Seminar - Saturday Full House, Left Sunday's Slot

I just received a word from the organizer that the Saturday's (22th Oct 2011) registration was already full house, only Sunday's slot is available (23rd Oct 2011). There are not many seats left for the Sunday's session, so if you are available, try to make it.

The details of the seminar is as below:

Date: 23 October 2011 (Sunday)

Time: 0930 to 1230

Venue: 6 Battery Road,

#40-06,

Singapore 049909

(Next to Raffles Place MRT)

Contact Gill at manveer.gill@cityindexasia.com with the following format.

Subject: Attending RonaldK Gumption Seminar

Contents of email: I want to attend RonaldK Gumption Seminar. Please kindly register me.

Or alternatively you can call at 6826 9974 to register.

Ronald K

The details of the seminar is as below:

Date: 23 October 2011 (Sunday)

Time: 0930 to 1230

Venue: 6 Battery Road,

#40-06,

Singapore 049909

(Next to Raffles Place MRT)

Contact Gill at manveer.gill@cityindexasia.com with the following format.

Subject: Attending RonaldK Gumption Seminar

Contents of email: I want to attend RonaldK Gumption Seminar. Please kindly register me.

Or alternatively you can call at 6826 9974 to register.

Ronald K

Labels:

market outlook

Saturday, October 8, 2011

Noble Group - The New Stratagems

While many of the public might still be bullish yesterday, I had already spotted a K Turn and started to short down. To me, there was too much buying excitement that the market was feeding to the public and I knew once gain, I need to capitalize on that opportunity to kill that excitement. The nexus created by the supply was obvious to warrant me a short.

Yesterday I had booked all my profits for all my longed positions, while a fan of mine was telling me that he longed Kepland, I can only judiciously and laconically reply and said that I can't advise and had booked all my profits. As stated on my disclaimer, I don't give investment/trading advise. You have to depend on yourself and do your due diligence.

I shorted Noble because I saw BBs unloading action being discernible. I tried a new strategy of mine to see it if works and yes it did. This strategy was to short at safe price instead of the day high price. I am beginning to fall in love with safe price rather than high/low price. It's absolute infallible because of the high degree of it accuracy and it's effectiveness. I shall share more on my Gumption Seminar. As this is an experiment, I had to cover my Noble shorts on the same day. Nevertheless it was a success and I shall continue to experiment a few more rounds.

I am preparing my powerpoint slides for the Gumption Seminar and if you are inspired to be an astute trader or a bright investor, this seminar is for you. I will try my best to fill in the missing ingredient in your trading/investment journey.

Ronald K

Labels:

STI

Friday, October 7, 2011

The Gumption Seminar

I am honored once again to be invited by CityIndex as an invited guest speaker. I remember the last time round, I was sharing about my K Wave, K Mind and K Turn. This time, it would be something totally different. I shall reveal more on that day.

The details of the seminar is as below:

Date: 22 October 2011 (Saturday) and 23 October 2011 (Sunday)

Time: 0930 to 1230

Venue: 6 Battery Road,

#40-06,

Singapore 049909

(Next to Raffles Place MRT)

Contact Gill at manveer.gill@cityindexasia.com with the following format.

Subject: Attending RonaldK Gumption Seminar

Contents of email: I want to attend RonaldK Gumption Seminar. Please kindly register me.

Or alternatively you can call at 6826 9974 to register.

Registration online will be much faster than phone. Spaces are limited, so register before seats are taken up.

Ronald K

The details of the seminar is as below:

Date: 22 October 2011 (Saturday) and 23 October 2011 (Sunday)

Time: 0930 to 1230

Venue: 6 Battery Road,

#40-06,

Singapore 049909

(Next to Raffles Place MRT)

Contact Gill at manveer.gill@cityindexasia.com with the following format.

Subject: Attending RonaldK Gumption Seminar

Contents of email: I want to attend RonaldK Gumption Seminar. Please kindly register me.

Or alternatively you can call at 6826 9974 to register.

Registration online will be much faster than phone. Spaces are limited, so register before seats are taken up.

Ronald K

Labels:

market outlook

Thursday, October 6, 2011

STI - Small Lesson, Big Reward

On Oct 4th, 2011, my student SMSed me about the direction of the market and I told him I expect a rally soon. Did I longed the market on Oct 4th, 2011? Oh yes I did! Did I cut some losses? Oh yes I did too! Woohoo, remember what I said in the seminar, I love cutting losses, because everytime I cut loss, I have a rough idea of what is going to happen. True enough, I am rewarded big time from the market. Now, a lot of people asked me for tips, I wish I could help you guys but seriously, when I cut loss, no one can react as fast as I do and I hate to beget people to lose money. I will feel really bad.

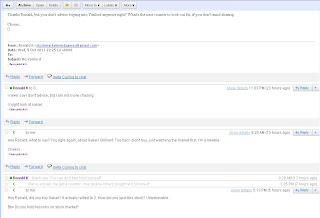

Read the continued saga between me and Robin. Although he was my teacher in the past, we shared different view when in comes to trading. Did I follow him, no I didn't. Of course I respect him for this guts and feel, but in order to be successful myself, I need to be solitude when I am trading and be on the contrary. Even if my teacher says he is shorting, I got to believe in my skill and follow my own trading plan. He can only be my teacher for a while, but I need to be my master of myself. To tell you the truth, even after learning from him, I never smsed or call him for tips or which stocks to look out, I would rather lose more money to buy experience. I still have some mental impediments within myself that I need to overcome and I am slowly practicing towards it. It's only for me to know and for you to guess.

For those who wants to get to know my teacher Robin, you can send me an email. I will try to arrange a session with him. However no promises because he is a super super big trader and is very busy but I will try my best.

Ronald K

Labels:

STI

Wednesday, October 5, 2011

Yanlord - The Longwaited Breakout !

I received a lot of negative feedback about me saying that Yanlord is my favorite stock that I am stucked with or I am influencing others to buy Yanlord with me. Well, I shall take those feedback as positive comments to improve myself better and I will never argue with anyone because no one knows how I punt or view this market except a few of you. Also, I don't owe anyone anything as I don't charge a fee or collect funds from public. The purpose of this blog is not to induce any buy/sell activity but strictly for educational purposes. If you don't like what you see, please refrain yourself from visiting my blog.

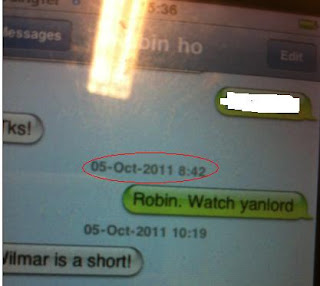

On Sep 30th, a student of mine SMSed me and asked me if it is time to buy Yanlord and I told him someone was secretly buying this stock and put that in his watchlist. Yanlord is due for a rebound soon and i told him the time is next week, which was this week of course. (You can read the whole conversation on the picture attached) This morning, I SMSed Robin at 8.42am, my teacher, a person whom I respected a lot because of the way he trades and the life catastrophe he had been through. I specifically asked him to watch Yanlord because I knew it is ready to breakout today. I believe he saw himself and profited from it.

Now the question is, after for almost a week, how do I know Yanlord is ready to breakout today? I believe a lot of people are very interested. Those interested parties, you can email me.

Ronald K

Labels:

Major Turns,

yanlord

STI - Key Reversal

While I am firm on my analysis when STI hits 2560, I am hitting the bull's eye again. STI indeed touched 2559 and rebounded all the way up until the noon where everything started to tank again. I knew what was going on but I decided to keep mum because I never wanted to cause anyone to lose money. Put it this way, my trading style suits me and it might not suit you. I love to test the market myself and do my cutting losses and that might not appeal to others, so the best is take every advice with a pinch of salt and do your own analysis. The final blow out to 2630 is totally understandable. This is to put the public off and beget them to liquidate more. While in my seminar I said the levels in STI to watch out for are 2560 and 2330, this is truly one of its kind where it did touch 2560 and rebounded! Now, can anyone tell me who can give precise levels and thereafter the market react accordingly? This week, I already gave two, one at 2627 and 2560. Both to me are very accurate and succinct to the point. I think I had caught the bottom once again and this is not the first time I had done it. I need not prove anything to anyone and I take negative feedback as a channel to improve myself further. Those who had been following me closely shall know.

Yesterday, I believe it's the start of a reversal. Today I believe it's the start of rising upwave. Y'all can decide for yourself to long or to continue to short. Happy trading.

Ronald K

Labels:

STI

Tuesday, October 4, 2011

STI - The 2560 Level

While I don't really like to issue levels, I thought it would be beneficial to those who watched for support and resistance levels. The 2560 is a crucial level to watch out for. Personally, I think that is the level where BBs would look to conduct a minor/major rally. The level is just a ballpark figure, it might sometimes break below 2560 a little more before it rebounds. As usual, I will watch for turns. That ascribed me a more powerful and confirmatory entry.

Ronald K

Labels:

STI

Monday, October 3, 2011

STI - Materialized Trading Plan

Yesterday, I gave away my trading plan. Earlier this morning, I saw a rebound after STI touched 2631 which was a dream plan came true once again. Around 9.26am, I saw the bulls were exhausted to continue it's upwave and that's where I knew a massive downwave energized my blithely spirit. Although I didn't post it on my blog, that's because I was very busy with my other work. Anyway, the astute BBs once again facilitated me in my plan. I got to thank them for giving me face every time. :) To be as successful as the BBs, one should never be an inveterate gambler but instead follow their actions.

Ronald K

Labels:

STI

Subscribe to:

Comments (Atom)