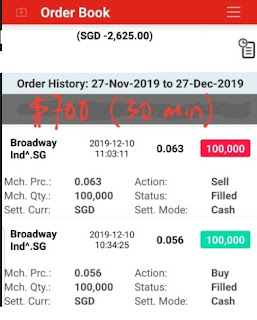

Mr Khoo is an amateur newbie trader where he doesn't know anything about stocks or equities. I remembered before he started learning from me, he had this decisive quality which I really admire which not everyone has. At that point of time when he enrolled for my class, I knew soon or later, he will start banking the market with profits. Today, he shared how he made $11,000+ profits trading the penny stocks I shared in my private sessions and on my blog.

He wanted to do this video and shared with the bottom from his heart. Although along the way he did some stupid stuff, still, I think as a newbie, mistakes is unavoidable but profits speak volume. Enjoy the video and learn from him. If he can achieve it with ease, everyone has the same opportunity too. Just take the right actions with calculated risk.

If you are a newbie or don't know anything about the stock market but yet want to make $$ using a powerful strategy that I will be sharing, register for my talk on Jan 15th 2020 and I will show you all how to detect big players movements using the Top 30 Volume. I will also share all my recent trades and the amount of $$ I made over the past 1 month together with my traders'. Click on the link below and see you soon!

Click to register for a Preview of Step by Step Stock Manual Revealed

Ronald K - Market Psychologist - A Stock Market Opportunist