Shorted the market last evening as the Dow hit a supply zone. It was a tricky short as the market lately gained some momentum on strength and hence a quick short is more risk adverse as compared to holding it for a swing trade instead. From the 5 minute chart, there was a long bar up where a lot of retails bought on breakout to only realized they were killed on the way down. Made like $9000 and had coffee some with traders to share on how did it. As the market gained more momentum, the risk of shorting is high but one needs to be nimble so as to avoid any losses.

Disclaimer: The purpose of this blog is not intended to induce or promote any insider trading or manipulation activity. This blog is created for the sole purpose of education, discussion and knowledge sharing. All charts and information can be obtained freely from the public internet. All analysis are based on my own personal view and years of experience. It should not be used as a decision to solicit buy/sell activity. Use all information at your own discretion and practice due diligence.

Pages

- stockmarketmindgames

- The K Theory

- K Philosophy

- Track & Trade Record

- Charity

- Company Information

- Business Opportunities

- Contact Me

- About Me

- Advertising

- Media

- Partners

- Stock Operation Course Summary

- Stock Operation Course Outline

- Mind Analysis

- Testimonials

- The Science Behind Precision Timing

- LIVE Trading, Events, Sharing Videos

- The Retrovention Of Contra Trading

- 1 On 1 Personal Coaching

- Stock Operation Course FAQ

- Stock Operators Maneuvers Manual

- Stock Operation Framework

- FREE Training Workshop

- Disclaimer

Friday, December 2, 2022

Trading Dow Futures - Profited $9000 SGD

Labels:

cafe,

dow,

dow jones,

LIVE Trading,

profits,

Ronald K,

seminar,

singapore,

successful traders,

trade history,

trade records,

traders,

Trading

Thursday, December 1, 2022

Trading Dow Futures - Profited $50,626 SGD

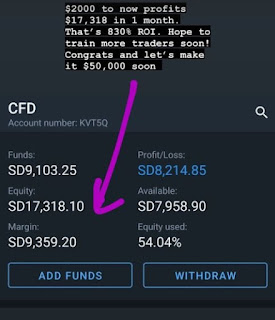

Finished my last evening for the year in the office with many of my traders coming and wanting to seek more answers from the market and also what's going to happen in 2023. Shared the outlook, relearn the strategies and in 2023, it's going to be another year of trading without much investments to the market. Received a new trade record from my student where he made like $17,318 so far using a small capital of $2000 which was a ROI of 830% within a month. It's super impressive and I showed it to everyone who came for the event yesterday.

Went back, studied the market and started entering all my trade parameters. I did not get in at a good price but I knew where the market was moving and hence I set a stop loss to protect my capital. I allowed the market to do it's magic in the night and woke up with $50,686 profits. The chart with the long trading range and a flush was key pivotal points of entry before the good news was released while the market jerk up higher on the news that Fed slowing rate hikes soon. The actual news is not important but the entry points BEFORE the news is crucial. Overall another good trade and great profits. Moving on to the next.

Labels:

dow,

dow jones,

LIVE Trading,

profits,

Ronald K,

seminar,

singapore,

student,

students,

successful traders,

trade history,

trade records,

traders,

Trading

Friday, November 25, 2022

Trading Dow Futures - Profited $98,000 SGD

I did trade the Dow Futures while I was in Japan as the signals were flashing right there at the right place and right time. In the 1 hour chart, the Dow futures had some flushes and ws before buyers started to buy. The market in general is still very volatile and hence most of the trades were short term. Swung the trades for almost 2 weeks before profits were materialized earlier in the morning. I guess the key is to observe pivotal points like the circled areas before hitting the buy/sell button. Overall, it's been another good trade in Japan because profits were made. I am travelling soon again and these profits can be used to fund the next trip.

Labels:

cafe,

dow,

dow jones,

profits,

Ronald K,

singapore,

successful traders,

trade history,

trade records,

traders,

Trading

Sunday, November 20, 2022

Trading Dow Jones - 800% in 1 Month, Impressive Trades

Impressive trades from many of my students. From account size of $2000, it grew to $15,900 in a month. And another student made profits of $27,000 USD even when she's 68 years old. The market collapsed last month and suddenly there was a reversal upwards with some good news from the Fed. Whether it is shorting the market last month of buying the market up when it turned, I guess the most important thing is taking the right action when opportunity presented itself. Congrats everyone! It's such a good feeling to be able to receive so many great records when I just touched down Singapore. More hungry traders soon!

Labels:

appreciation,

compliment,

dow,

dow jones,

profits,

Ronald K,

singapore,

student,

students,

successful traders,

tesla,

trade history,

trade records,

traders,

Trading

Friday, October 28, 2022

Trading Dow Jones - Performance Driven with Great Profits

Extremely happy and delighted to see great results from my students whom I selected to have coffee with me and also some of them whom I met in a watch event where they continued to trade the Dow Jones with great profits. One of the things I pitched during my coffee and my class is, there is no need to have big capital, if you know how to find the correct entry signals and if you use the right trading account, profits should be easy to reap. So look at the trade records from various students, from a small sized account, it grew to between 100%-200% within 1-2 weeks. It's freaking impressive and like I always told them, be performance driven than to be greedy. Don't focus on the money, be laser focused on the skills, signals and take profits when the market is about to turn. Good job guys!!

Labels:

appreciation,

compliment,

dow,

dow jones,

profits,

singapore,

student,

students,

successful traders,

tesla,

trade history,

trade records,

traders,

Trading

Wednesday, August 24, 2022

Dow Jones Selling - The Best Short Selling Signal

Yet another impressive win from the same client I had coffee with 2 days ago.

She continued to have her wins in short selling the market and although not many trades, still the wins were great and the confidence is building up. From the 5 minute chart, there are signs that the bulls were weak and the bears were about to take control. See those circled areas, those are heavy distribution zone where buyers used the opportunity to sell on rising price while sellers took advantage to short sell more. I am training more clients like her so that everyone can take advantage of bad market conditions to profit handsomely. Congratulations on your wins again!

Labels:

cafe,

dow,

dow jones,

profits,

singapore,

student,

students,

successful traders,

trade history,

trade records,

traders,

Trading

Tuesday, August 23, 2022

Wall Street Trading - The Best Performance

Super impressive wins from my clients as they were all charged to take advantage of the heavy sell down in Wall Street to profit handsomely for their own pocket. The course and manual which they bought from me came into use especially when those obvious signals were flashing strongly in the 5 minute chart of the Dow Jones. From the heavy supply zone to the later on plunge, the strategies to predict it BEFORE the meltdown was all recorded in various chapters and it came into play last 2 nights. From $1000 to making $10,000 in 2 nights was simple impressive and astounding. That's like a 1000% ROI within in a short time frame for the pocket. Also that calculative trades in the Wall Street with consistent wins was another highlight where she took advantage of the market volatile to short sell with guaranteed stop loss. Overall, I am delighted to see results like this and will drive more clients to profit with me. :)

Labels:

dow,

dow jones,

profits,

singapore,

student,

students,

successful traders,

trade history,

trade records,

traders,

Trading

Sunday, August 21, 2022

Dow Jones - Trading for Breakthrough

Another great performance and great results after 3 days of opening account and trading the Dow Jones. Very impressive with this client as she's very driven to make $$ in trading indices and making it consistent on her results. I mean coffee is great but following instructions strictly on the stocks and advice is equally important for breakthrough performances. Looking forward to coach her more and help her with her trading and performance.

Labels:

appreciation,

compliment,

dow,

dow jones,

profits,

singapore,

student,

students,

successful traders,

trade history,

trade records,

traders,

Trading

Friday, August 19, 2022

Bed Bath & Beyond - Ryan Cohen Dumped His Entire Bed Bath & Beyond Stake

Ryan Cohen just confimed that he sold his entire 9.5m stake in BBBY on Tuesday and Wednesday and the news caused to the stock dropped 44% post market. It's a bad bad news as the stock shot up wildly to only realized that it's now having a free fall because of big investors heavy selling. However if you study closely the chart, there were already so much tell tale signs that the stock was about to collapse. See my sell position when I sold near peak on Wednesday.

The top volume was flashing BBBY last evening signalling that there was heavy selling last evening. From the distribution to the re-distribution, the stock was just so weak that the buying couldn't sustain the selling and it had to fall. If you watch the market last evening, you will see how those long red bars were furious as it got sold down which indicated heavy selling from big whales. Now that in the post market it dropped 44% to $10++, it just proved that one needs the chart to aid them in their buying/selling to avoid being dumped by the stock.

Cassava Sciences - Traded $10M, Day 2, Pump and Dump

What an extremely choppy day in the stock market last evening. The market rebounded and all of a sudden it fizzled again and then rebounded again and then dead off again. It's not an easy day trading the market so stocks selection is the key towards trading efficiently. Cassava Sciences once again experienced a pump and dump, exactly what it did in day 1 however this time round, the stock gap up first and dumped all the way down. It's the same maneuver from the big whales but a slightly differently style in the dump.

Ronnard - Market Psychologist - A Stock Market Opportunist

Labels:

berkshire hathaway,

Cassava Sciences,

profits,

Ronald K,

singapore,

successful traders,

trade history,

trade records,

traders,

Trading,

US

Thursday, August 18, 2022

Cassava Sciences - Insider Buying, Stock Surged 27.26%

Cassava Sciences is an extremely risky stock with a high short interest float where the number of short sellers on this stock weighs more than the buyers. Hence it's a prime candidate for a short squeeze effect should the stock release any good news. BBBY run was simply amazing as the stock had like almost 400% ROI in 1 week but it has already ran up a lot so it's time to search for another one and I discovered Cassava Sciences while doing my daily homework.

The stock shot up very big time yesterday with high volume on great news as insiders were buying the stock which attracted the public to buy on this good news. Price was running up wild like crazy and many were chasing on rising prices and it seemed to never stop. In just a short time span of an hour, the stock rampant up from $24 to $34 where it seemed like there wasn't any signs of stopping this rampage bull. Retails were chasing while once again I saw some secret selling occurred as prices were jerking higher. At the very last bar in the 5 minute chart, it was a super long green bar and I knew it's time to unload every and run. Soon after, the stock just collapsed profusely and never recovered. The classic pump and dump which was recorded in my SOMM Manual happened over and over again in many of the risky penny stocks which I think if you know how to spot, buy and then sell, the profits can be astounding within minutes. Although the stock released good news, but because of the high short interest float in this counter, at certain point, I do expect a bounce like what we witnessed yesterday. :)

Labels:

berkshire hathaway,

Cassava Sciences,

profits,

Ronald K,

singapore,

successful traders,

trade history,

trade records,

traders,

Trading,

US

Subscribe to:

Posts (Atom)