Yanzhou Coal Mining Co. (1171) agreed to acquire Gloucester Coal Ltd. for about A$700 million ($709 million) and a 23 percent stake in its Australian unit, gaining mines and port capacity in the largest coal-exporting nation.

Under the plan, Sydney-based Gloucester will merge with Yancoal Australia Ltd., and Yanzhou will own 77 percent of the new company, the Chinese coal producer said yesterday in a statement. Gloucester stockholders will receive A$3.20 a share in cash, it said.

Buying Gloucester, controlled by

Noble Group Ltd. (NOBL), will add four coal projects and access to ports in Australia, where Yanzhou operates six mines. Yanzhou plans to boost annual output there to about 30 million metric tons from about 16 million tons in the next five years to help meet growing demand from

China, UBS AG said in a Dec. 20 note, citing an investor presentation.

“

Yanzhou Coal wants to make sure its coal-mine portfolio in Australia is strong enough to support its production growth in years to come,” said Felix Lam, a Hong Kong-based analyst at Daiwa Securities Capital Markets Co. “The port facilities are of strategic importance because they will allow it to connect its mining sites directly to marine transportation.”

Yanzhou’s board approved the transaction, the company said in an earlier statement. It’s advised by Citigroup Inc., UBS and Goldman Sachs (Asia) LLC, as well as by law firms Freehills,

Baker & McKenzie and King & Wood. Gloucester is advised by Lazard Ltd. and Noble by Blackstone Group LP.

Coal Deals Increase

Coal deals involving companies in

Australia swelled to more than $11 billion this year from $9.44 billion in 2010, according to data compiled by Bloomberg. The biggest transaction was Peabody Energy Corp.’s $4 billion takeover of Macarthur Coal Ltd. in July. The average premium paid globally this year in coal acquisitions is 19 percent, the data show.

Yanzhou also offered a payment of as much as A$3 a share should the stock fall below A$6.96 in the 18 months after the deal closes, according to the statement. The so-called value protection clause and the dividend payment imply a value of A$2.2 billion for Gloucester, a person with knowledge of the matter said, declining to be identified.

Calls to Marie Festa, director of

investor relations at Gloucester Coal, went unanswered after normal business hours.

Australian Trading

Yancoal Australia will replace Gloucester on the country’s stock exchange, allowing Yanzhou to use the purchase as a means of listing its Australian assets. Gloucester closed at A$7.03 in Sydney on Dec. 19 before trading in the shares was suspended.

Yancoal Australia is required to list at least 30 percent of its local assets by the end of 2012 as part of conditions attached to its A$3.1 billion takeover of Felix Resources Ltd. in 2009.

“Upon completion of the merger proposal we will have made a significant step toward meeting all the undertakings including a listing of Yancoal core assets,” Yanzhou said in the statement. Some of those assets aren’t included in the merger plan, which is subject to approval from Chinese and Australian regulators, and from Gloucester holders, the statement shows.

Yanzhou can profit from shipping coal back to

Asia rather than relying on local markets. It’s among producers expanding as demand from power utilities and steelmakers rises, while asset prices drop. Global consumption of the fuel is projected to climb by an annual 2.8 percent in the six years to 2016, driven by China’s economic growth, the

International Energy Agency said this month.

Yancoal Expansion

Yancoal may spend more than $1 billion buying mines in Australia, Murray Bailey, managing director of the unit, said in a September interview. Yancoal had net income of A$415 million for the year to Dec. 31 and debt of A$3.3 billion, according to a statement on its website.

Noble, a Singapore-listed commodities supplier, owns 64.5 percent of

Gloucester (GCL), according to data compiled by Bloomberg. Noble, whose main business involves trading and shipping bulk commodities including coal, took control of the company in 2009 when it offered A$7 a share. Chief Executive Officer Ricardo Leiman quit last month after Noble reported a quarterly loss.

Noble shares have declined 45 percent this year in

Singapore.

Yanzhou this month proposed selling as much as 15 billion yuan ($2.4 billion) in bonds over three years. Buying Gloucester would be Yanzhou’s fourth acquisition in Australia following the Felix takeover, the purchase of coal developer Syntech Resources Pty for A$202.5 million in August and two coal subsidiaries of Wesfarmers Ltd. in September for A$296.8 million.

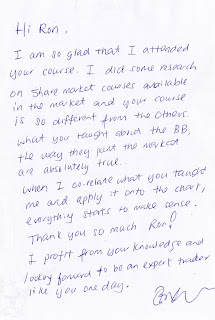

Ronald K - Market Psychologist - The Big Speculator