The Nasdaq rebounded last evening with a strong note. However it plummeted down heavily since June 8th after I sold all my shares and it never recovered till yesterday. Click the link below and read my post when I sold all my shares on June 8th at 9.55pm at the peak price where I predicted before the Nasdaq was going to plunge and hence my action was to sell first before I suffer any losses. In fact, I can buy more shares at lower prices so why hold on to something that was going to drop ayway?

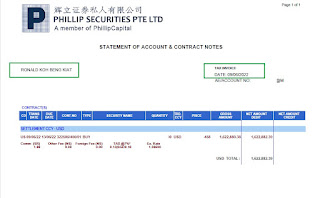

June had been a good month for me as you can see from the trade records above that I was trading millions of $$ mad crazily due to the high volatility in the market which presented a lot of opportunities. In and out frequently and without a single loss was a testament of my trading skills over the years of observing and trading stocks. Well, the market did recover a little yesterday and I was there to trade the move up. It's been a rough month for many traders and investors but if you know how to read charts on how big whales move stocks, then it's pretty easy to spot opportunities everyday be it up/down.