Last Friday, I made a post on my blog at 7:12PM

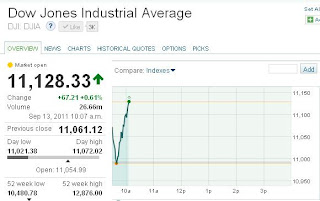

http://stockmarketmindgames.blogspot.com/2011/09/market-outlook-next-week-mind-games.html I said that I knew what's was going to happen next week (which is this week) before the opening bell in Dow Jones. The trading session for Dow is at 9.30PM every night. After I posted, I told everyone who emailed me to short on rally as the market is weak. See the above email. The first email I got was at 7:31PM and subsequently, it leads to many emails after that. How do I knew that? Because I saw unloading action and a bearish trap. I am not looking to long anymore until I see some signs of preparation for a rally.

If there is one stock that I look to short, that would be STXOSV, of course I won't be chasing, I will only short at the turn.

Finally, how did I manage to speculate the future accurately in the past few months? (If you had been reading my blog). I went through hardships and different stages in my life and I only manage to see the light only after cooling down and meditation. I shall leave this passage for some enlightenment. It helps me a lot during my down time and I would love to share with all my fans.

People who suffer will accordingly gain wisdom. If we don't suffer, we don't

contemplate. If we don't contemplate, no wisdom is born. without wisdom, we don't

know. Not knowing, we can't get free of suffering - that's the way it is. (

This is to tell you that only by losing will you start to gain insights and slowly think of a way out.)

If you reach out and grab a fire in your neighbor's house, the fire will be hot. If

you grab a fire in your own house, that too will be hot. So don't grab at anything

that can burn you, no matter what or where it is. (

This is to tell you to let go traditional teachings and don't hold on to anything that you knew in the past, be FLEXIBLE!)

Know your own body, heart and mind. Be content with little. Don't be attached to

teachings. Don't go and hold onto emotions. (

This is to tell you to expect less and gain more when you trade.)

Ronald K