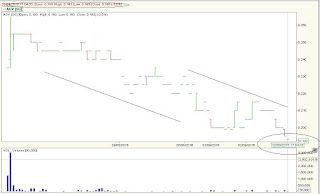

I had been providing a bearish outlook on AGV since the day it went IPO, LIVE on my blog. Click and see my 2 posts below!

http://stockmarketmindgames.blogspot.sg/2016/08/agv-new-ipo-stock.html

http://stockmarketmindgames.blogspot.sg/2016/08/agv-saw-sellers.html

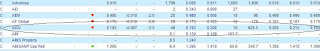

In my outlook for AGV, I was bearish as I mentioned that this stock contains sellers and I expect a sell down. 5 days after it's debut, the stock did not perform and consistently suffered selling, reaching a day low of 0.193 yesterday. I strongly believe that if one choose to play IPO stock, he/she needs to select a good one or the downside risk is quite high. The problem is those prospectus reports cannot foresee the price up/down when it's listed in the exchange on the first day and hence I don't use that in my trading plan because it's worthless.

The most important clue towards finding a good IPO stock is to know who is behind the stock. This can be a daunting task but once you get it right, the risk is much lower. Don't study facts and figure but rather study the past records of the person behind the stock is more important than anything else. I would check what other counters the person was involved in and verify it with the charts to his past performance. Unfortunately, it's hard to share more without a whiteboard and marker and hence I will share it in my private sessions. You will be amazed how easy it is!

Ronald K - Market Psychologist - A Stock Market Opportunist